What is Hedging: As per the business directory, Hedging is a risk management strategy used in limiting or offsetting probability of loss from fluctuations in the prices of commodities, currencies, or securities. In effect, hedging is a transfer of risk without buying insurance policies. Hedging is done by the various risk derivatives. To understand this, it is important to first understand the basics of risk derivatives.

Broadly speaking there are two types of risk derivatives. Exchange traded and over the counter derivatives. As the name suggests, exchange traded derivatives are traded in the international exchanges (for example New York Mercantile exchange, NYMEX), where standard contracts, terms of which have been defined by the exchange are traded.

Over the counter (OTC) derivatives are traded through dealers and the contracts are tailor made. OTC derivatives come with the risk of other party not fulfilling his obligations.

In the trade exchange, future contracts and Options contract derivative are normally traded and Oil/gas companies choose these two hedging contracts.

To understand these hedging techniques, assume that I am oil/gas Production Company and I am producing 100000 barrels in a month. Today’s crude oil price is $80/barrel. I am afraid that by next month , when I will have inventory of around 100000 barrels, the crude oil price may fall to below $75/Barrel, and I might make a loss of $500000 compared with today’s crude oil price. Lets see how I can use hedging to reduce this loss.

1. Future and Forward contracts:

(The fundamental difference between future and forward contracts is that one is traded in exchanges while other is traded OTC, here I will discuss Future contracts).

“Future contracts between two parties A & B is a contract where party B has the obligation to deliver a commodity on agreed date and party A has the obligation to pay on same date the price, which is agreed today”.

So in my case I am party B and in a future contract with A today, I agree to deliver 100000 barrels of crude oil on 11th Dec 2014 and party A agrees to pay the listed price for Dec 2014 in the trade exchange (say NYMEX). Let us assume the listed price for Dec 2014 is $81/Barrel. It is important to note that I do not have to actually (physically) deliver the crude oil to party A.

Now in Dec 2014 when I have produced 100000 barrels of crude oil. Lets consider two scenarios

Scenario 1: Crude price drops to $75/barrels as expected by me.

In the Physical market

I sell 100000 barrels of crude oil @ $75/barrel to get $7500000 where as I had expected $8000000 so I incur loss of $500000 in the physical market.

In the Future contract

My obligation is to deliver 100000 barrels of crude oil which in dec 2014 will cost me $7500000 @ $75/barrel. But party A has the obligation to pay me @$81/barrel so total of $8100000. This way in the future contract I make profit of $600000.

Net profit I make is $600000 (Future contract) – $500000 (Physical market) = $100000

So I have hedged the crude oil price with future contract.

Scenario 2: Crude price increase to $82/barrels.

In the Physical market

I sell 100000 barrels of crude oil @ $82/barrel to get $8200000 where as I had expected $8000000 so I have profit of $200000 in the physical market.

In the Future contract

My obligation is to deliver 100000 barrels of crude oil which in Dec 2014 will cost me $8200000 @ $82/barrel. But party A has the obligation to pay me @$81/barrel so total of $8100000. This way in the future contract I make loss of $100000.

Net profit I make is $200000 (Physical market) – $100000 (Future contract) = $100000

So in both case of crude oil price reducing or increasing, I have made more money than I had expected in Nov 2014. With different number, it might also show some loss, even with future contract but the loss will be much lesser than what would have been incurred without hedging.

2. Hedging by OPTIONS Contract

There are two types of options contracts. Call & Put.

The relevant contract for me as Oil/gas production company will be PUT options.

“When I buy PUT options contract from another party (say party A), I have the option to sell my commodity (crude oil in this case) to party A at a particular price but I am not obliged to do so. It is upto me, if I want to exercise my option to sell my commodity to party A. My this right has an expiry date and I can use my option on any date before the expiry”.

Off course I will only exercise my option if the price of the crude oil has decreased and not if the price of crude oil has increased. However to buy this right (option contract) I have to pay a premium to party A.

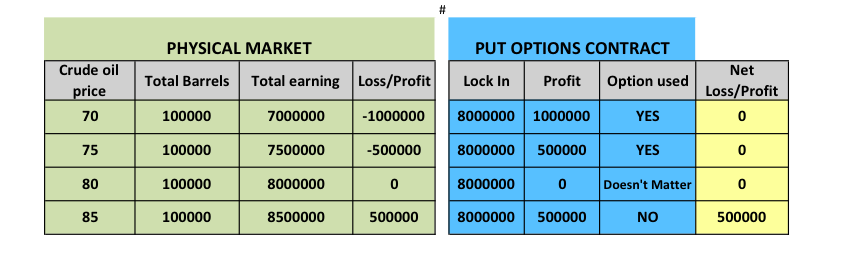

Let us assume that I buy “Put option contract” from party A at lock in price of $80/Barrel for crude oil. Table above shows, how after using “Hedging by Options contract”, I do not incur any loss even when the price of crude oil has fallen from $80 to $70.

Share this:

About Capt Rajeev Jassal

Capt. Rajeev Jassal has sailed for over 24 years mainly on crude oil, product and chemical tankers. He holds MBA in shipping & Logistics degree from London. He has done extensive research on quantitatively measuring Safety culture onboard and safety climate ashore which he believes is the most important element for safer shipping.

Search Blog

8 Comments

Rychlá pujcka ze soukromých zdroju - 35,000, -Kc to 2,500,000, -Kc. Dostali jste se do situace, kdy si potrebujete nutne pujcit? Neuspeli jste v bance ani u nebankovních spolecností. Soukromý investor nabízí ješte dnes okamžité rešení, vyrízení - Online. Za pár minut máte poproblemému - finance na vašem úctu. Pomužeme vám s címkoli at rešíte pujcku, smenku, konsolidaci, exekuci, podnikání, bydlení nebo jste jen nevyšli s penezi. Z pohodlí vašeho domova nás kontaktujte na. Milankouba222@gmail.com

Rychlá pujcka ze soukromých zdroju - 35.000,-Kc až 2.500.000,-Kc. Dostali jste se do situace, kdy si potrebujete nutne pujcit ? Neuspeli jste v bance ani u nebankovních spolecností. Soukromý investor nabízí ješte dnes okamžité rešení, vyrízení – Online. Za pár minut máte po problému – finance na vašem úctu. Pomužeme vám s címkoli at rešíte pujcku, smenku, konsolidaci, exekuci, podnikání, bydlení nebo jste jen nevyšli s penezi. Z pohodlí vašeho domova nás kontaktujte na. alesevzen5645@gmail.com

Rychlá pujcka ze soukromých zdroju - 35.000,-Kc až 2.500.000,-Kc. Dostali jste se do situace, kdy si potrebujete nutne pujcit ? Neuspeli jste v bance ani u nebankovních spolecností. Soukromý investor nabízí ješte dnes okamžité rešení, vyrízení – Online. Za pár minut máte po problému – finance na vašem úctu. Pomužeme vám s címkoli at rešíte pujcku, smenku, konsolidaci, exekuci, podnikání, bydlení nebo jste jen nevyšli s penezi. Z pohodlí vašeho domova nás kontaktujte na. alesevzen5645@gmail.com

Have a look at this infographic that explains in great detail as to what causes oil prices to fluctuate and how to do valuation for oil companies.

https://insightsartist.com/how-to-analyze-oil-and-gas-company-for-investment/

Psychedelic is a relating or denoting drug (especially LSD) that produces hallucinations and apparent expansion of consciousness. Psychedelic therapy is a technique that involves the use of psychedelic substances to aid the therapeutic process. Lsd for sale

Hello, We Offer Swift MT760 BG/SBLC, FC MTN, Letter of Credit { LC }, MT103Etc. N/B: Provider's Bank move first. Let me know if you have any need for the above offers. Thanks Name: Jerry Osborne Email: osbornej715@gmail.com

Leave Comment

More things to do on myseatime

MySeaTime Blogs

Learn the difficult concepts of sailing described in a easy and story-telling way. These detailed and well researched articles provides value reading for all ranks.

Seafarers Question Answers

Ask or answer a question on this forum. Knowledge dies if it remains in our head. Share your knowledge by writing answers to the question

MySeaTime Podcast

This podcast on the maritime matters will provide value to the listeners. Short, crisp and full of value. Stay tuned for this section.

Rychlá pujcka ze soukromých zdroju - 35,000, -Kc to 2,500,000, -Kc. Dostali jste se do situace, kdy si potrebujete nutne pujcit? Neuspeli jste v bance ani u nebankovních spolecností. Soukromý investor nabízí ješte dnes okamžité rešení, vyrízení - Online. Za pár minut máte poproblemému - finance na vašem úctu. Pomužeme vám s címkoli at rešíte pujcku, smenku, konsolidaci, exekuci, podnikání, bydlení nebo jste jen nevyšli s penezi. Z pohodlí vašeho domova nás kontaktujte na. Milankouba222@gmail.com